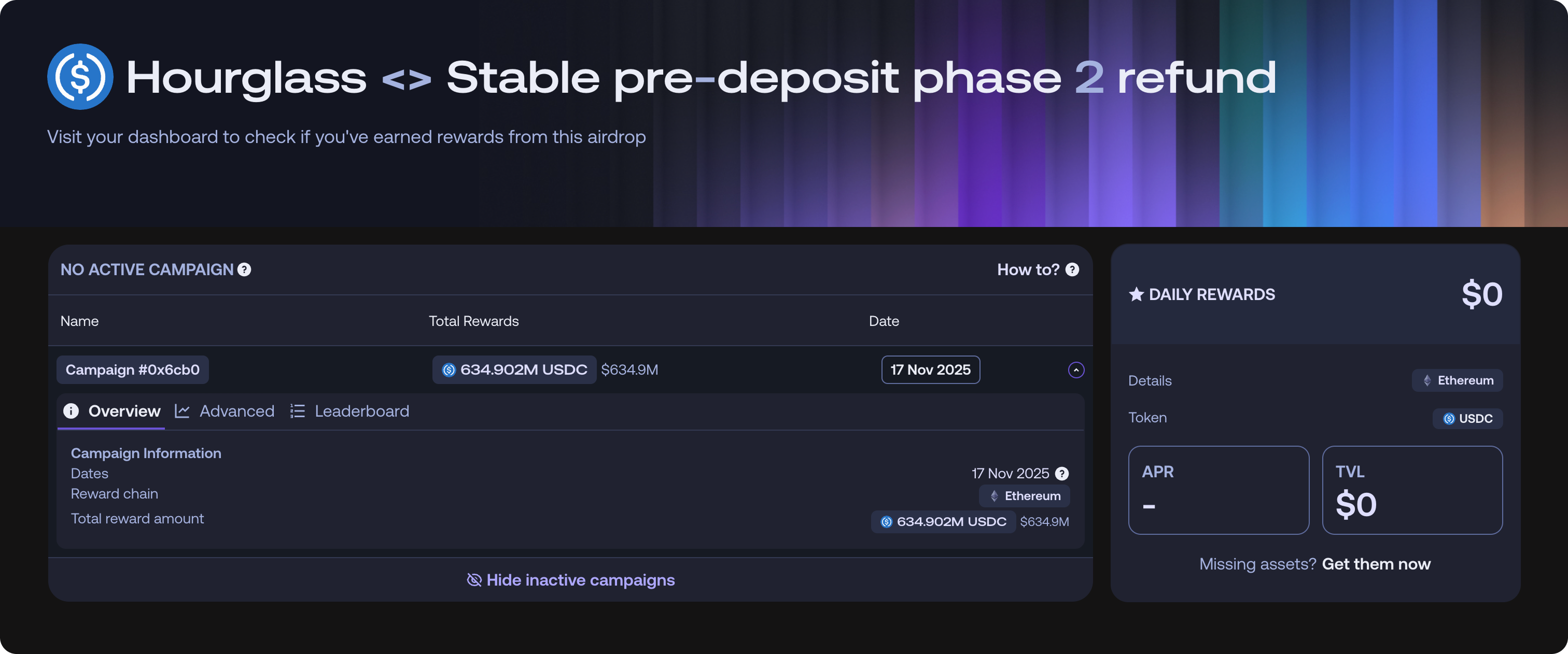

How Merkl Powered a $634M Refund While Keeping Funds Fully Secure

Challenge

Stable is a new blockchain built for stablecoins and designed to enable seamless digital-dollar transactions at global scale. Its ambition is to become the settlement layer for global finance.

Ahead of its mainnet launch, Stable organized a pre-deposit program to ensure the chain would start with strong liquidity. As part of this program, users could deposit USDC on Ethereum into a vault managed by Hourglass. In return, once Stable launched, these users would receive iUSDT on the Stable chain, along with a yield to reward them for providing early liquidity.

The program was so successful that the vault cap of 500M USDC was exceeded, reaching 1.13B in total deposits.

As a result, about 634M USDC had to be refunded to the users who deposited beyond the cap.

Hourglass and Stable needed a solution that could:

- Reliably refund hundreds of millions of dollars

- Distribute funds to thousands of users

- And do so securely, without relinquishing control of the vault’s assets

Merkl quickly emerged as the ideal solution.

Solution

Merkl was selected to power the $634M USDC refund, thanks to its unique combination of scalability, reliability, and flexibility.

Handling an airdrop is one thing. Handling a $634M refund, where precision and security are critical, is another entirely.

To ensure absolute safety, Merkl designed an approach that allowed Hourglass to keep full control of the funds at all times, while still leveraging Merkl’s powerful distribution engine.

Instead of transferring funds to Merkl for distribution, which would have introduced unnecessary risk, Merkl engineered a secure solution.

The Merkl team created a token wrapper contract that allowed users to claim their refunds through the familiar Merkl interface. To enable this, Merkl distributed placeholder tokens to eligible users.

When users came to claim their refunds, they interacted with these tokens as if they were receiving USDC directly. Behind the scenes, the wrapper contract triggered the actual transfer of funds, calling the Hourglass-controlled vault to send the correct amount of USDC to each user. Hourglass set initial USDC limits inside the vault that the Merkl wrapper contract was permitted to draw from. These limits were gradually increased over time as the refund progressed, allowing Hourglass to stay in full control of the funds while enabling Merkl to process claims efficiently.

For users, everything felt completely natural. The wrapper contract remained invisible in the interface, keeping the experience smooth and simple.

Only by inspecting the transaction on Etherscan could one see the more complex sequence:

- A claim transaction between the user and the Merkl wrapper contract

- Followed by an automated transfer from the vault holding the USDC to the user address

This architecture allowed Merkl to deliver a smooth user experience while guaranteeing maximum safety for large-scale fund handling.

What convinced us was Merkl’s ability to adapt their architecture to our security requirements. They delivered a custom wrapper flow that made the refund seamless for users while ensuring Hourglass retained strict control over the vault at all times.

Incentivize any use case

Liquidity provisioning

Learn more →Lending & borrowing

Learn more →Point system

Learn more →Airdrop

Learn more →Grant distribution

Learn more →Token launch

Learn more →Stablecoin

Learn more →Don't see your use case?

Send us a message →Results

Merkl successfully executed the $634M USDC refund.

The numbers highlight Merkl’s performance:

- $500M claimed within the first 20 hours

- ~9,000 addresses refunded in 5 days

- 100% of funds distributed safely

This case demonstrates that Merkl is not just a reward distribution infrastructure. It is also a powerful solution for large-scale refunds and fund disbursements of any kind.

Merkl enabled Stable and Hourglass to deliver a best-in-class user experience while maintaining absolute control and security over substantial amounts of capital, proving once again the strength and reliability of the Merkl Engine and infrastructure.